Your Resource for the Latest Insights and Health Insurance Trends

At RMTS, we are the architects of lasting stability for our clients and partners. We’re dedicated to sharing access to our industry expertise and resources. From the latest news and trends in the health insurance industry to our insights on medical stop-loss, risk management, captive insurance, and more—we provide the “Blueprint” for success.

Upcoming Events

The Blueprint

Stay in the Know with RMTS' "Blueprint" for Success

Read our blog to keep up with the latest industry news, benefit offerings, and our custom solutions.

Looking to stay up to date on the industry’s latest? Concerned about new compliance regulations? Our newsletter keeps you in the know! From new legislation to health insurance trends, sign up today and never miss an update.

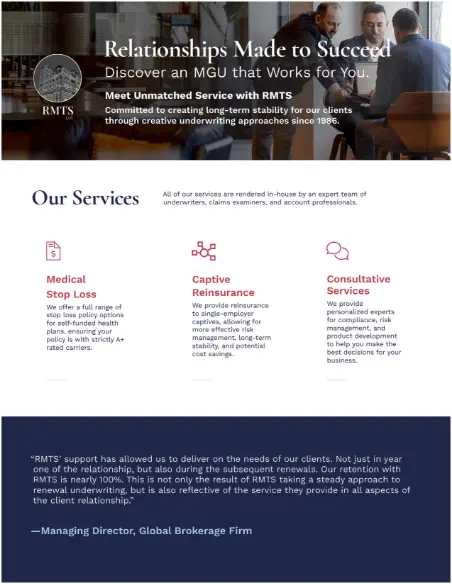

As a nationwide managing general underwriter, RMTS partners with a broad range of private and public entities in a variety of industries who take advantage of the self-funded health plan model for benefit plans. Our services are tailored to meet whatever your needs are, from medical stop-loss, risk management, and more.

Explore our resources and start crafting your own blueprint for success!

Craft Your Own Blueprint

Reach out to RMTS today!